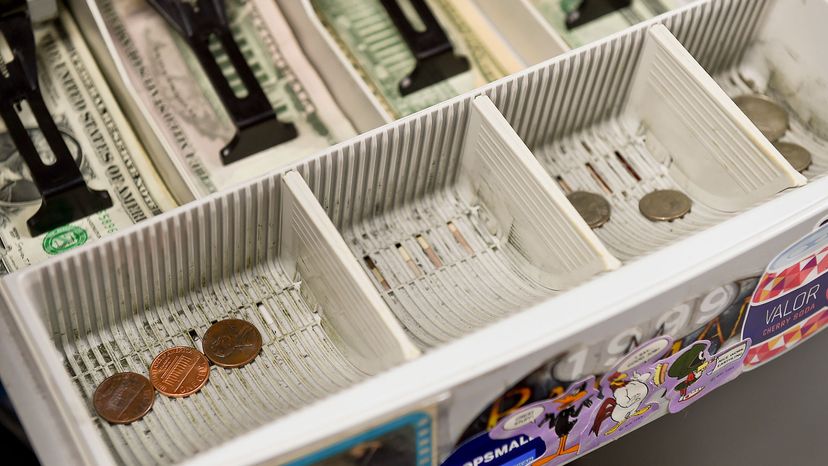

“The change drawer of the cash register at Symbiote Collectibles in West Reading, Pennsylvania, in early July shows the effect of the current coin shortage. Ben Hasty/MediaNews Group/Reading Eagle via Getty Images

“The change drawer of the cash register at Symbiote Collectibles in West Reading, Pennsylvania, in early July shows the effect of the current coin shortage. Ben Hasty/MediaNews Group/Reading Eagle via Getty Images

At grocery stores, convenience stores and hardware stores across America, curious signs popped up over the summer of 2020 asking customers to pay with credit cards, debit cards or exact change. Was it because cashiers didn’t want to handle physical dollars and cents that could be contaminated with the coronavirus? Nope, it’s because the United States was experiencing a severe coin shortage.

Yes, if wearing masks, hoarding toilet paper and canceling summer plans wasn’t annoying enough, Americans also had to sacrifice the 46 cents in change from their drive-thru iced latte.

Where Did All the Coins Go?

America’s pennies, nickels, dimes and quarters didn’t disappear; the COVID-19 pandemic simply disrupted the normal cycle of coin circulation. According to the U.S. Treasury, there were $47.8 billion of coins in circulation as of April 2020, which was actually $400 million more than in April 2019, but those coins weren’t moving through the economy like they should have been.

The Federal Reserve gave several reasons as to why there were fewer coins in circulation:

- Banks and businesses nationwide closed their doors during the lockdown phases of the pandemic, including cash- and coin-heavy sectors like convenience stores, public transit and laundromats.

- The U.S. Mint also slowed its production of new coins during the early stages of the pandemic as staff was reduced for safety reasons at the mint’s Philadelphia and Denver locations.

- Even as the economy reopened, consumers opted for "contactless" payment and generally used less cash and coins, meaning more coins were sitting at home in Mason jars, piggy banks and under couch cushions.

What Was the Impact of the Coin Shortage?

Retail stores felt the pinch and passed the inconvenience along to their customers. The National Grocers Association and several other retail industry trade groups sent a strongly worded letter to Federal Reserve Chair Jerome Powell and Treasury Secretary Steven Mnuchin in late June 2020 saying that rationing coin shipments to banks "threatens the functioning of our member businesses and, by extension, the needs of our customers."

In their letter, the groups cited economic statistics showing that cash is still very much king in certain sectors and among certain consumer demographics:

- 45-60 percent of sales at grocery stores and convenience stores are cash payments

- Nearly half of all transactions of $10 or less are paid in cash

- Consumers with an annual household income of $25,000 or less pay cash in 43 percent of transactions

What Was the Solution?

The U.S. Mint dramatically ramped up coin production, outpacing its usual 1 billion coins a month with 1.59 billion coins in June and higher-than-normal volume throughout the rest of 2020, according to CoinNews.net.

The Federal Reserve announced in June that it was rationing out its coin inventory by sending banks and credit unions smaller-than-normal coin shipments based on historical demand.

The Fed also convened an emergency U.S. Coin Task Force in July composed of government and industry leaders, including banks and armored car companies. One of the task force’s early accomplishments was to create the hashtag #getcoinmoving, which banks and credit unions plastered across Twitter to encourage people to cash in their piggy banks to get more coins back in circulation.

Some banks even took matters into their own hands. Valliance Bank in Oklahoma City launched a coin drive among its customers, awarding free lunches to the branches and customers that collected the most coins.

By the close of 2020, the U.S. Mint’s two facilities in Denver and Philadelphia had stamped out 26 percent more coins than the previous year, according to American Banker. As a result of increased coin production, plus a gradual reopening of the economy in most states, the coin shortage appeared to mostly over by January 2021 with banks able to fill coin orders for grocery stores, laundromats and other coin-heavy businesses.

Now That’s Cool

A coin can remain in circulation for up to 30 years, while paper bills are usually retired after only 18 months.

Originally Published: Jul 27, 2020